Introduction: A Turning Point for WBD

Warner Bros. Discovery (WBD) shocked the media world on June 9, 2025, by announcing that it will spin off its streaming and studio assets into one public company and separate its traditional cable and broadcast business into another. This marks a pivotal reversal of the 2022 merger that merged WarnerMedia with Discovery. The split is scheduled to finalize by mid‑2026 and aligns with broader industry trends where media giants realign to maximize value amid streaming dominance.

What Exactly Is Being Split? Understanding the Two New Companies

1. Streaming & Studios

- Includes HBO, HBO Max (soon returning to the HBO Max name), Warner Bros. film and TV, DC Studios, and gaming studios.

- Led by CEO David Zaslav.

- Focus: produce premium content, expand streaming subscriber base, and improve profitability via scale.

2. Global Networks

- Houses CNN, TBS, TNT Sports, Discovery Channel, Discovery+, Bleacher Report, and other cable assets.

- Headed by CFO-turned-CEO Gunnar Wiedenfels.

- Keeps most of WBD’s ~$37–38 billion debt and retains a 20% stake in Streaming & Studios to support deleveraging.

Why Now? Key Drivers Behind the Split

1. Declining Cable Business

Cable TV subscriptions in the U.S. have dropped from ~100 million in 2015 to ~60 million today—highlighting shifting consumer habits.

Financial pressure from falling advertising revenue and subscriber loss makes cable a drag on the combined entity.

2. Debt Reduction & Strategic Clarity

Post-merger, WBD carried ~$50 billion in debt. Currently rated “junk,” the company secured a $17.5 billion bridge loan from JP Morgan to facilitate the carve‑up.

Spinning off each division allows targeted debt structuring, helping them stand alone.

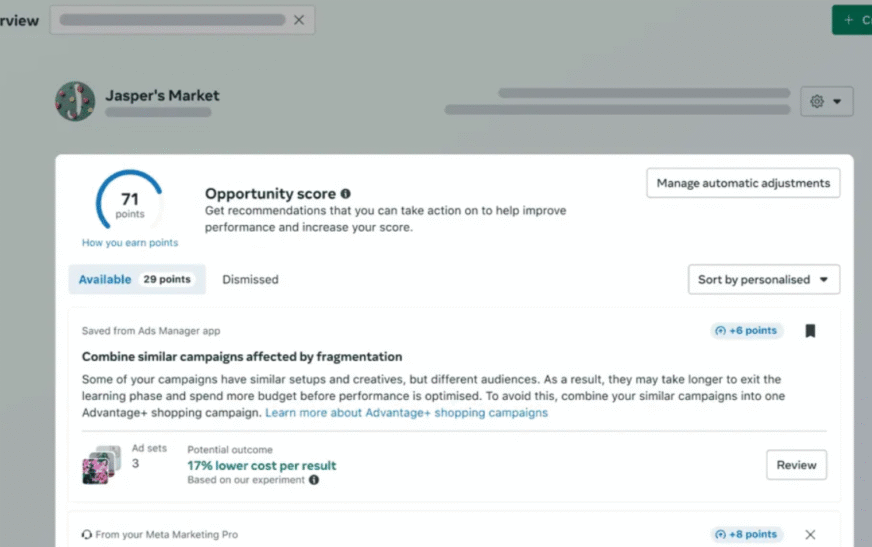

3. Investor Pressure & Market Value

Shares have dropped around 60% since the 2022 merger—despite a post-announcement bump of ~8–13%.

Investors and analysts view this move as unlocking value, giving each business sharper focus.

4. Industry Realignment

WBD isn’t alone—Comcast and Lionsgate have similar plans to separate cable networks from streaming units.

This fragmentation helps streamline strategy and prepare entities for potential M&A.

Leadership & Financial Structure Post-Split

- David Zaslav remains CEO of Streaming & Studios, focusing on content growth and subscriber scaling.

- Gunnar Wiedenfels transitions to lead Global Networks, overseeing debt reduction and cable optimization.

- Bridge loan and strategic bond offerings will finance the transition. Global Networks plans to use its equity stake to pay down debt.

Market Response

- Immediate investor reaction was enthusiastic, with shares rallying 8–13% intraday.

- Analysts from UBS, Bank of America, Lightshed, and others praised the move as strategically sound.

- However, there are cautions: separating entities “could hamstring operations until the transition is complete.” Industry watchers warn both companies must address operational challenges and leverage structure.

Strategic Implications

For Streaming & Studios

- A leaner, higher-growth unit focused on global streaming and blockbuster content will better compete with Netflix, Disney+, and Amazon Prime.

- Profitability goal: >$1.3 billion by end of 2025 and 150 million subscribers by end of 2026.

For Global Networks

- The priority is managing debt, stabilizing cash flow, and potentially packaging cable assets for acquisition—a la Comcast’s spin-off of NBCUniversal’s cable business.

- Maintaining presence in the digital sphere via Discovery+ and Bleacher Report adds streaming exposure to the cable arm.

Potential Risks & Headwinds

- Operational Complexity: Spinning off can create friction—license renewals, cross-company cost allocation, content distribution deals could become messy.

- Debt Pressure: Both entities still hold high leverage; bondholder pushback is possible during refinancing.

- Regulatory Scrutiny: With Trump administration’s prior antagonism toward CNN, regulatory checks may shape future transactions.

- Competition: Streaming & Studios must accelerate global subscriber growth and profitability in a competitive environment; Nielsen data shows WBD trailing major.

Industry-Wide Trends & Competitive Strategies

- Comcast’s Versant spinoff, Lionsgate-Starz breakup, and Disney’s contemplation of ABC sale reflect pressure on legacy media to restructure.

- The goal across the industry: unlock shareholder value by making streaming segments standalone growth engines while detaching lagging cable divisions.

- Major M&A activity could follow, especially with linear assets potentially merging under single buyers—regulators will watch closely.