The European Commission is making headlines again—this time for targeting tech giant Meta Platforms (formerly Facebook Inc.). In a sharp escalation, the EU has warned Meta that it may face daily fines for allegedly violating a previous antitrust order under the Digital Markets Act (DMA). The core issue? Meta’s controversial “pay-or-consent” advertising model, which the Commission claims still fails to meet legal standards for user data privacy and fair competition.

This case not only underscores the EU’s aggressive stance on regulating gatekeeper platforms but also sets the tone for global tech regulation in the digital economy.

Why Meta Is in Trouble with the European Union

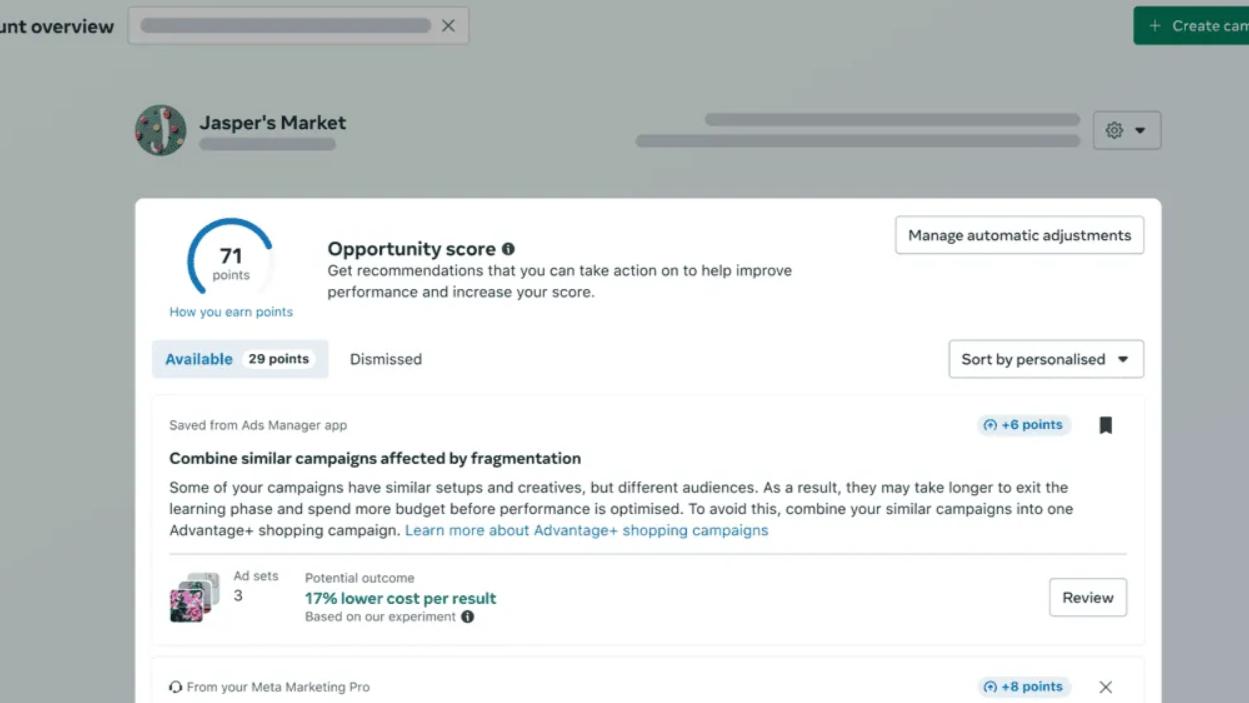

Meta’s revised model—offering users a choice to either pay a monthly subscription to avoid ads or consent to data tracking—hasn’t convinced EU regulators. The model was meant to address user privacy concerns stemming from its earlier data monetization practices, but the Commission found the changes insufficient and still non-compliant.

The European Commission warns that if Meta fails to comply with the order by June 27, 2025, it may face daily fines of up to 5% of its global daily turnover.

That’s a potentially massive sum, considering Meta’s scale, and it emphasizes the importance of strict enforcement of the Digital Markets Act.

How the Pay-or-Consent Model Became a Flashpoint

The pay-or-consent model introduced by Meta in November 2023 aimed to offer EU users a choice: either pay for an ad-free experience or allow personalized ads by agreeing to tracking.

However, the EU argues that:

- The choice is not truly free because of economic coercion.

- The burden of data privacy is unfairly placed on the user.

- Meta has not provided any genuine alternatives that respect user rights.

As of now, Meta claims its updated model goes beyond legal obligations, but regulators disagree.

What Happens If Meta Doesn’t Comply?

If Meta fails to meet the European Commission’s ruling, the company could face:

- Daily fines of up to 5% of its average global daily revenue

- A ban on certain targeted advertising practices

- Possible restrictions on operations within EU member states

For context, 5% of Meta’s global daily revenue could mean millions of dollars per day.

These penalties demonstrate the EU’s commitment to Digital Services Act enforcement and signal a no-tolerance policy on non-compliance by tech gatekeepers.

Why the EU’s Action Sets a Global Precedent

This isn’t just a battle between the EU and Meta—it’s a defining moment in global tech regulation. The Digital Markets Act is now viewed as one of the strongest regulatory tools ever implemented.

Here’s why it matters:

- U.S. regulators like the FTC are observing closely.

- Other markets (India, UK, Australia) are adopting gatekeeper regulation frameworks.

- Tech platforms worldwide may need to realign their data policies to stay compliant.

Impact on Advertisers, Users & Businesses

1. For Advertisers

If Meta’s ad targeting is restricted, advertisers may face:

- Lower audience segmentation accuracy

- Decreased conversion rates

- Higher cost-per-click (CPC) due to inefficiencies

2. For Users

While intended to protect data privacy, users may experience:

- Reduced platform features

- Forced into paying for ad-free experiences

3. For Businesses

Brands relying heavily on Facebook ads or Instagram promotions may have to pivot toward:

- Google Ads alternatives

- Email marketing campaigns

- Enhanced SEO strategy

Meta’s Response: Going on the Offensive?

Meta has responded by stating that:

- Their latest ad model complies with EU regulations

- The Commission is moving the goalpost with unclear guidelines

- The ruling represents a threat to innovation

Meta may take the battle to the European Court of Justice—continuing a long-standing feud between Big Tech and European regulators.

What’s Next? Enforcement Timeline Breakdown

| Date | Event |

|---|---|

| Nov 2023 | Meta launches pay-or-consent model in EU |

| April 2025 | EU deems model non-compliant |

| June 27, 2025 | Final deadline to align with the DMA |

| July 2025+ | Daily fines may begin if issues persist |

If Meta fails to act, this could escalate to include further fines, advertising bans, or market limitations across the European Union.

Meta at a Regulatory Crossroads

This warning to Meta marks a critical turning point in the battle between Big Tech and global regulatory frameworks. The Digital Markets Act isn’t just legislation—it’s a declaration that gatekeepers must play fair or face the financial consequences.

For businesses, advertisers, and users, this ruling could reshape the digital landscape, influencing everything from ad targeting to user experience design and data governance.