Ensuring SEBI‑compliant verification for securities and investment ads in India isn’t just a checkbox—it’s a game-changer for transparency, ad accountability, and consumer trust. In this blog, we’ll walk through why Meta’s recent policy move requires ads to display verified SEBI credentials, outline the process advertisers must follow, and show how adopting these measures positions your brand ahead of regulatory curve. All while embedding high-volume anchor keywords for SEO and keeping the tone human and engaging.

Why SEBI Verification Matters

With a surge in finfluencer fraud, SEBI has tightened rules. On March 21, 2025, intermediaries were instructed to register with platforms like Google and Meta, ensuring ads come from verified sources. Now, Meta has taken this further: from July 31, 2025, all securities and investment ads targeting India must verify both beneficiary and payer identities using SEBI registration metadata.

This landmark shift addresses issues tied to misleading claims and unregulated financial advice—essential steps toward restoring investor protection and ad trust.

Meta + SEBI: A New Era for Transparency

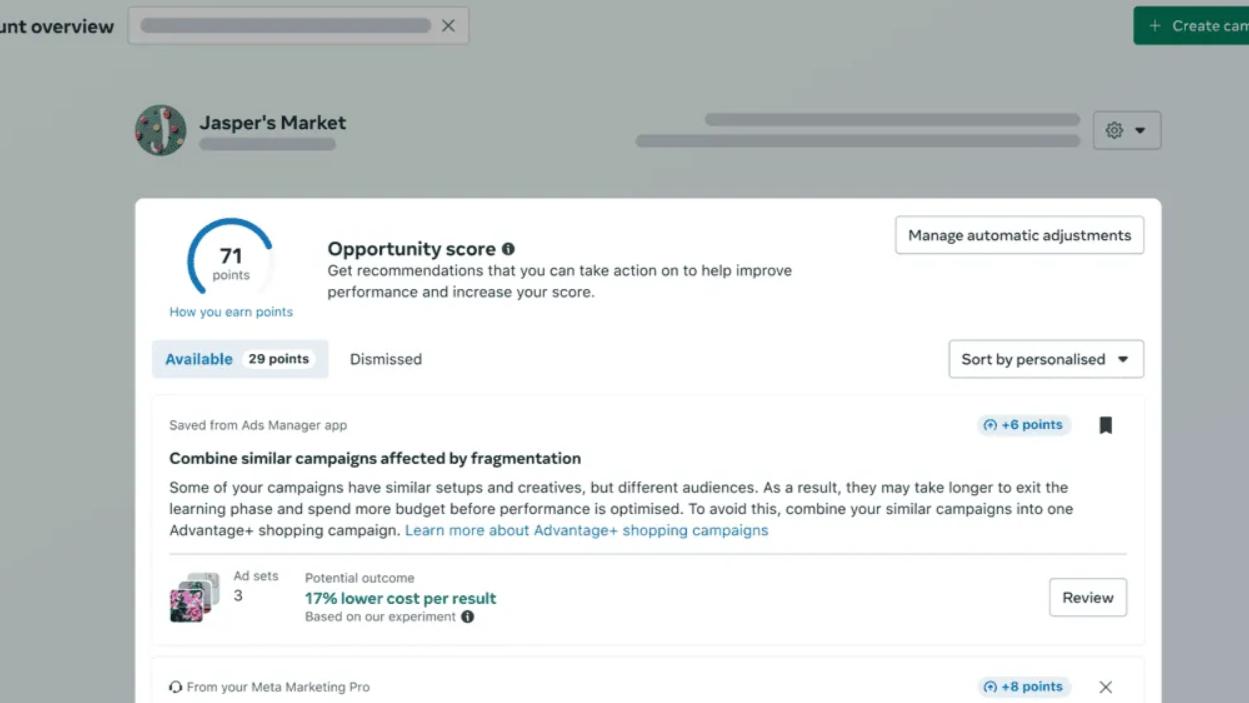

Meta began rolling out its verification feature on June 26, 2025, with full global rollout by July 28, 2025. While advertisers receive banners like “Verification required for securities and investment ads in India”, active ads running before July 31 remain valid if verification is completed in time.

What Advertisers Need to Do

- Verify advertiser identity

- For SEBI-registered entities, provide registration ID, beneficiary, and payer info.

- Exempt organisations (like financial educators) must undergo alternative verification via government ID or business documents.

- Select verified identity details in Meta Business Suite using “Authorizations & Verifications” tab.

- Public display of verified info on ads, including SEBI registration number, name, and location. This stays in the Ad Library for seven years.

- Maintain compliance posture by ensuring access privileges and verification for agencies running ads.

Skipping this process risks your ads being blocked from Indian audiences—and that’s a risk no advertiser wants.

Benefits of Adopting SEBI‑Compliant Verification

- Boost in ad trust: audiences see verified credentials and are more likely to engage.

- Regulatory alignment with Meta and SEBI ensures a safer ad ecosystem.

- Brand uplift in an era demanding ad transparency and accountability.

- Early adopter advantage as compliance sets you apart from laggards.

Embedding SEBI‑compliant verification into your strategy isn’t just lawful—it’s smart marketing.

Key Elements to Include in Investment Ads

SEBI guidelines for investment-related advertising require several critical inclusions:

- Company name & SEBI registration

- Registered office address, brand logo, CIN

- Standard risk disclaimer, “Investment in securities market are subject to market risks…” at font size ≥10

- No guaranteed returns or misleading promises

- Clear disclaimer for any example securities

- For audio-video ads: risk warning must be voiced and visible for at least 10 seconds

Including these items ensures full compliance and enhances your credibility.

Practical Timeline & FAQs

| Date | Requirement |

|---|---|

| Before Apr 30, 2025 | Intermediaries registered with platforms using SEBI portal details |

| March 2025 | Meta announced verification mandate |

| June 26, 2025 | Verification tools rollout begins |

| July 28, 2025 | 100% global availability |

| July 31, 2025 | Enforcement for all ads targeting India |

Do existing ads need changes?

No—ads live before July 31 can continue if the account completes verification.

What if I’m not SEBI‑registered?

Alternative business or ID-based verification within Meta is accepted.

How long is info visible?

Verified details remain on Meta’s Ad Library for 7 years.

How to Embed This in Your Ad Content

- At ad setup, ensure you choose verified beneficiary/payer info.

- In ad creative, display:

- “SEBI Regn. No. INZ123456789” beneath your logo.

- Standard risk declaration for at least 10 seconds in videos.

- Maintain clear brand positioning—no misleading qualifiers.

Align messaging strictly with financial ad transparency, steering clear of unverified performance claims or guaranteed returns.

Human-Centric Edge

Think of SEBI‑compliant verification not as red tape, but as trust infrastructure. When users see your verified identity, registration number, and risk disclaimers, you’re not just complying—you’re saying, “We’re serious, professional, and here to stay.”

As an ad manager, this verification is a chance to build brand equity—not just follow rules.

- Register intermediary details with SEBI and platforms early.

- Complete Meta Business Suite verification well before July 31.

- Embed anchor phrases like advertiser identity verification and Meta Business Suite verification across your site and ads.

- Ensure compliant content: accurate SEBI info, risk disclaimers, no misleading promises.

- Track performance and audits via Ad Library and Search Console.

By treating SEBI‑compliant verification as both a compliance measure and a trust signal, you transform your ads from mere promotions into credible communication.

Let your next campaign be not just secure and compliant—but genuinely reassuring to your investors.