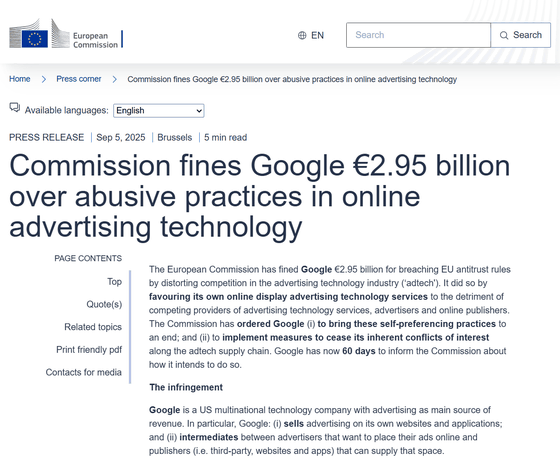

The European Commission has fined Google €2.95 billion (around $3.5 billion) for abusing its dominance in the advertising technology sector. This landmark decision marks one of the largest penalties ever imposed on a tech giant and signals a growing push for tougher competition regulation in digital markets.

The case revolves around Google’s control of its AdX exchange and DoubleClick for Publishers (DFP), where regulators found the company gave unfair preference to its own services. For advertisers, publishers, and businesses relying on Google’s ad-tech, this ruling could reshape the future of digital advertising.

What Happened?

According to the European Commission, Google abused its dominant position by:

- Prioritizing its AdX ad exchange in bidding processes.

- Limiting opportunities for rival ad-tech companies.

- Creating a conflict of interest by controlling both the buy side (advertisers) and the sell side (publishers) of the ad ecosystem.

The result? Competitors were disadvantaged, advertisers faced higher costs, and publishers earned less revenue.

This is not the first time the EU has fined Google. Previous cases involved Android bundling, search self-preferencing, and shopping ads, but the €2.95 billion fine shows regulators are now targeting Google’s core advertising business—the engine that generates the majority of its revenue.

What the EU Expects Next

Google has 60 days to propose compliance measures. If its plan doesn’t convince regulators, the EU may impose structural remedies, including forcing Google to divest parts of its ad-tech business.

That’s a massive deal. Breaking up or restructuring Google’s ad division could open new opportunities for independent ad-tech companies, while also reducing Google’s ability to control data and pricing in the market.

Google’s Response

Unsurprisingly, Google disagrees with the ruling and has confirmed it will appeal the decision. The company argues that:

- Its tools benefit both advertisers and publishers.

- A forced breakup could harm European businesses relying on Google Ads.

- The Commission has misunderstood the complexity of the ad-tech ecosystem.

Despite its defense, industry experts note that Google’s self-preferencing practices have long been a concern, and this fine may push regulators worldwide to act more aggressively.

Global Reactions

The ruling didn’t just stir debate in Europe—it triggered global political and regulatory responses:

- United States: The Department of Justice is pursuing a parallel case against Google’s ad-tech operations. This EU decision could strengthen the U.S. government’s stance.

- Canada and the UK: Regulators in both countries are intensifying their scrutiny of Google’s advertising dominance.

- Donald Trump’s Response: The former U.S. President criticized the fine as discriminatory and hinted at a trade retaliation investigation against the EU.

Clearly, this is more than just an EU vs. Google issue—it’s becoming a global antitrust showdown.

Why This Matters for Advertisers and Publishers

This decision could reshape the future of online advertising in several ways:

1. More Competition in Adtech

If Google is forced to separate its ad-tech business, smaller players like PubMatic, Magnite, or The Trade Desk could gain market share.

2. Potential Lower Costs

Advertisers may benefit from more transparent and competitive pricing instead of being funneled into Google’s ecosystem.

3. Higher Publisher Revenue

With fairer access to exchanges, publishers might see better returns from ad placements.

4. Compliance Challenges

Businesses using Google Ads will need to stay alert to changes in policies, tools, and data usage as the company adjusts to EU requirements.

Broader Implications for Big Tech

This ruling signals a new regulatory era. The EU is showing it is willing to go beyond fines and force structural change when necessary. For other tech giants like Meta, Amazon, and Apple, this is a warning: self-preferencing and monopolistic practices won’t go unchecked.

It also highlights the growing importance of digital competition laws, such as the EU’s Digital Markets Act (DMA), which aims to create a level playing field in the online economy.

Quick Facts Table

| Aspect | Details |

|---|---|

| Fine Amount | €2.95 billion (~$3.5 billion) |

| Violation | Abuse of dominance in ad-tech (AdX, DFP) |

| Remedy Window | 60 days to submit compliance plan |

| Possible Action | Structural remedies (including divestment) |

| Google’s Response | Plans to appeal, claims decision is harmful to businesses |

| Global Impact | U.S., UK, and Canada pursuing similar antitrust scrutiny |

Conclusion

The EU’s €2.95 billion fine against Google is not just another penalty—it’s a turning point for the ad-tech industry and for global competition law.

For advertisers and publishers, this could mean more opportunities, fairer prices, and better returns in the long term. For Google, it signals the biggest challenge yet to its advertising empire.

As regulators tighten their grip, businesses should diversify their digital marketing strategies to reduce dependency on a single platform. This ruling is a reminder that in today’s digital economy, competition and compliance go hand in hand.