In a significant move that could reshape the future of digital advertising in India, the Competition Commission of India (CCI) has officially launched a probe into Google’s AdTech dominance. This investigation follows a detailed complaint by the Alliance of Digital India Foundation (ADIF)—a group representing Indian startups and digital businesses—alleging that Google has been abusing its dominant position in the online advertising ecosystem.

This blog explores the background of the complaint, what it means for Google, and how it could impact publishers, advertisers, and AdTech competitors in India.

If you’re involved in digital marketing, adtech platforms, or are a stakeholder in the online advertising industry, this blog is for you.

What Triggered the CCI Investigation?

The CCI acted on a 2024 complaint filed by ADIF, which argued that Google’s ad tech stack engages in anti-competitive practices by:

- Bundling and tying its advertising tools (Google Ad Manager, AdX, and DV360)

- Favoring its own platforms over independent demand- and supply-side partners

- Restricting access to YouTube ad inventory unless advertisers use its DSP, DV360

The CCI found these allegations worth investigating and has initiated a consolidated probe into Google’s display advertising services under Section 4 of the Competition Act, which relates to the abuse of dominant position.

This investigation is being merged with four other ongoing probes into Google’s AdTech business practices, which highlights the regulatory body’s growing concern over Big Tech dominance in India’s digital economy.

Understanding Google’s AdTech Ecosystem

To understand the complaint, it’s essential to understand the structure of Google’s advertising tech stack, which includes:

- Google Ad Manager (GAM) – a supply-side platform (SSP) for publishers

- AdX (Ad Exchange) – Google’s real-time ad auction platform

- DV360 (Display & Video 360) – Google’s demand-side platform (DSP)

- YouTube Ads – served through DV360 with limited access via third-party DSPs

ADIF alleges that this closed-loop system gives Google an unfair advantage in the programmatic advertising ecosystem, reducing transparency, competition, and publisher earnings.

These concerns echo similar antitrust cases against Google’s advertising monopoly in the United States and European Union, making this a globally relevant issue.

What Is AdTech and Why Is It Important?

AdTech refers to the set of software, tools, and platforms used to deliver, manage, and measure digital advertising campaigns. Google dominates this ecosystem, handling publishers, advertisers, data analytics, and ad serving—all under one roof.

This vertical integration gives Google control over:

- Ad pricing

- Inventory access

- User targeting

- Revenue shares

For Indian advertisers and publishers, this means limited alternatives, opaque auction systems, and potential loss of ad revenue—hence, the increased scrutiny of Google’s AdTech practices.

Impact on Digital Advertising in India

The probe could have a significant impact on digital advertising in India, especially for:

- Startup advertisers who rely on open ad ecosystems

- Publishers and news media who want access to transparent and competitive bidding

- AdTech companies in India competing with Google’s massive ad infrastructure

If the CCI finds that Google’s practices violate India’s competition laws, it could impose:

- Heavy financial penalties

- Mandates to unbundle AdTech services

- Rules ensuring fair access to YouTube and AdX inventory

This could be a major win for India’s growing AdTech startups, especially those focusing on AI-powered ad targeting, real-time bidding platforms, and independent demand-side tools.

ADIF’s Claims Against Google

Here’s a deeper look at the core claims made by the Alliance of Digital India Foundation:

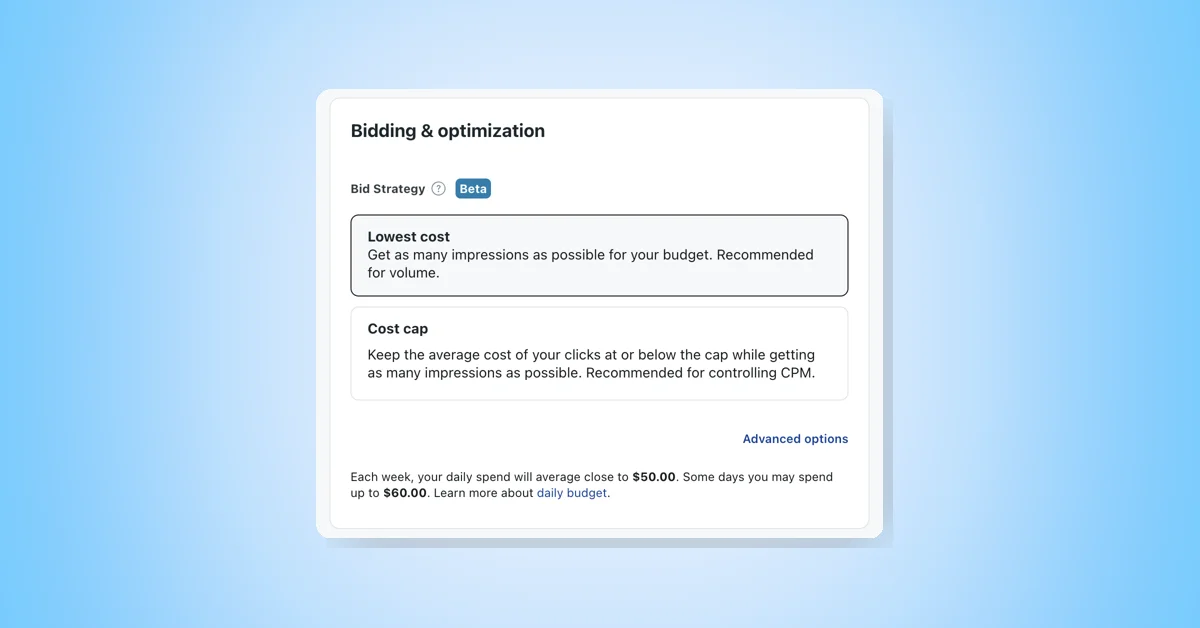

1. Tying and Bundling

Google allegedly requires the use of its own tools in combination—e.g., publishers using Ad Manager must also use AdX, and advertisers wanting to advertise on YouTube must use DV360.

This limits the use of third-party DSPs and forces publishers into Google’s closed ecosystem.

2. Self-Preferencing

Google allegedly gives preferential treatment to its own ads and clients in the bidding process, hurting fair competition.

3. Opaque Auction Systems

The lack of transparency in real-time bidding, including auction outcomes and revenue shares, leaves publishers and advertisers at a disadvantage.

4. Lack of Interoperability

Google’s tools allegedly don’t integrate well with third-party platforms, reducing choice and flexibility in ad operations.

Google’s Defense

Google, of course, has denied the charges, stating that:

- Its AdTech ecosystem includes interoperability options

- Advertisers and publishers are free to use competing platforms

- The Indian digital advertising market is competitive, with players like Amazon Ads, Xandr, and The Trade Desk operating successfully

However, CCI’s decision to move forward with the probe indicates that it sees a prima facie case of anti-competitive behavior.

Global Echoes of the Case

The Indian investigation into Google’s advertising dominance aligns with global antitrust movements, including:

- The U.S. Department of Justice’s lawsuit accusing Google of monopolizing the digital ad market

- The EU’s investigations into Google’s advertising auctions and bidding practices

- Australia’s push for greater transparency in adtech pricing and performance

This shows that antitrust scrutiny of Big Tech is a global trend—and India is playing a proactive role in holding tech giants accountable.

Legal Basis: Section 4 of the Competition Act

The CCI’s probe is based on Section 4 of the Indian Competition Act, which prohibits:

“Abuse of dominant position by any enterprise or group to impose unfair or discriminatory conditions or pricing in purchase or sale of goods or services.”

If found guilty, Google could face fines up to 10% of its India-based revenue and be forced to unbundle or open access to its advertising stack.

What This Means for Advertisers and Publishers

If you’re a stakeholder in the digital marketing industry, the outcome of this probe can change:

- How ads are bought and sold in India

- The transparency and fairness of programmatic advertising

- Access to open platforms for ad targeting and delivery

- The growth of India-based AdTech alternatives

Startups and media outlets who’ve felt crushed by Google’s dominance may soon see a more level playing field, with fair competition and greater revenue potential.

A Turning Point for India’s Digital Ad Market

The CCI’s probe into Google’s AdTech dominance could become a watershed moment in the evolution of India’s digital advertising ecosystem. While Google defends its model as interoperable and competitive, regulators and startups see the bundling of ad services and preferencing of Google tools as a direct threat to open market principles.

If the investigation leads to significant reforms, Indian advertisers and publishers might soon enjoy a more transparent, accessible, and competitive ad market—one where innovation isn’t stifled by monopolistic practices.

Stay tuned as the CCI’s findings unfold—this could mark a new chapter in digital advertising governance in India.