Snap Inc., the parent company of Snapchat, is facing one of its toughest phases yet. With ad revenue slowing down and a noticeable decline in active users, the social media giant has announced a major operational overhaul.

This restructuring signals how even leading digital platforms must constantly adapt to survive in an era of fierce competition, evolving user behavior, and changing advertiser expectations. In this blog, we’ll explore why Snap is struggling, what its new strategy looks like, and how it could impact advertisers, creators, and users worldwide.

The Challenges Facing Snap

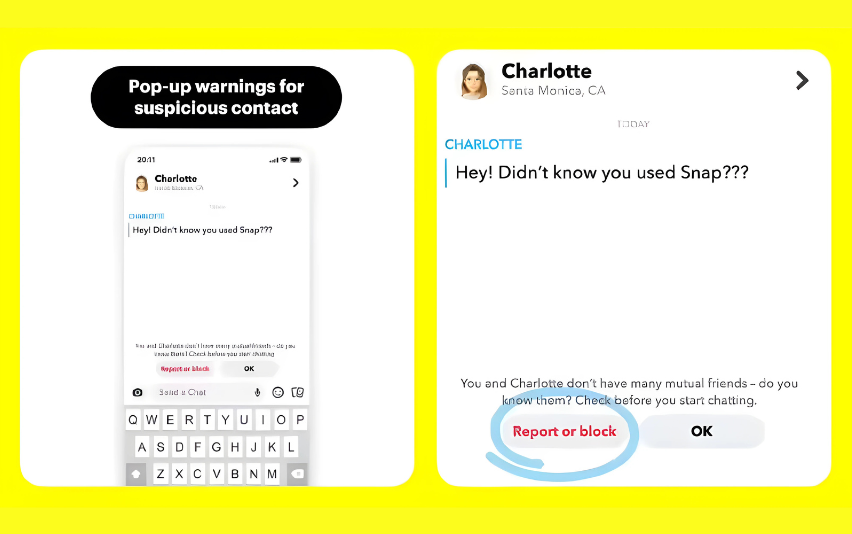

Snap has long positioned itself as the innovator in visual messaging with its disappearing snaps, Stories format, and AR filters. But the recent slowdown has revealed deeper issues:

- Slowing Ad Revenue Growth

- Advertisers are tightening budgets amid global economic uncertainty.

- Snap’s ad platform lags behind Meta and TikTok in targeting precision and ROI measurement.

- With competition from Reels, Shorts, and TikTok ads, brands are reallocating budgets away from Snapchat.

- Declining User Engagement

- While Snapchat once dominated the Gen Z audience, TikTok’s addictive short-form content has pulled users away.

- Daily active user growth has flattened, especially in mature markets like North America and Europe.

- Intensifying Competition

- Instagram continues to copy Snapchat features and scale them to its massive user base.

- YouTube Shorts and TikTok are setting new benchmarks for video engagement and creator monetization.

Snap’s Operational Overhaul

To tackle these challenges, Snap is restructuring its operations. Here’s what the overhaul looks like:

- Workforce Reductions: Snap is trimming its workforce to cut costs and focus resources on high-priority areas.

- Reallocation of Resources: More investment is going into AR innovation, AI-driven ad solutions, and subscription models like Snapchat+.

- Global Strategy Shift: Snap is focusing less on risky hardware projects (like Spectacles) and doubling down on core social experiences.

- Ad Platform Improvements: The company is rolling out new tools to help advertisers measure ROI, optimize campaigns, and compete more effectively with TikTok and Meta.

This overhaul is not just cost-cutting—it’s about rebuilding Snap’s identity as a creative, youth-focused platform while ensuring financial sustainability.

Why Ad Revenue Matters So Much

Like most social media companies, Snap relies heavily on digital advertising revenue. When advertisers cut back or shift budgets, the impact is immediate:

- Lower revenue growth → investor pressure → operational changes.

- Since advertisers prefer platforms with strong targeting and analytics, Snap must prove it can deliver results comparable to Meta and TikTok.

- With Snapchat+ subscriptions gaining traction, Snap is exploring diversification, but advertising remains the backbone.

Impact on Users

For everyday users, Snap’s restructuring could mean:

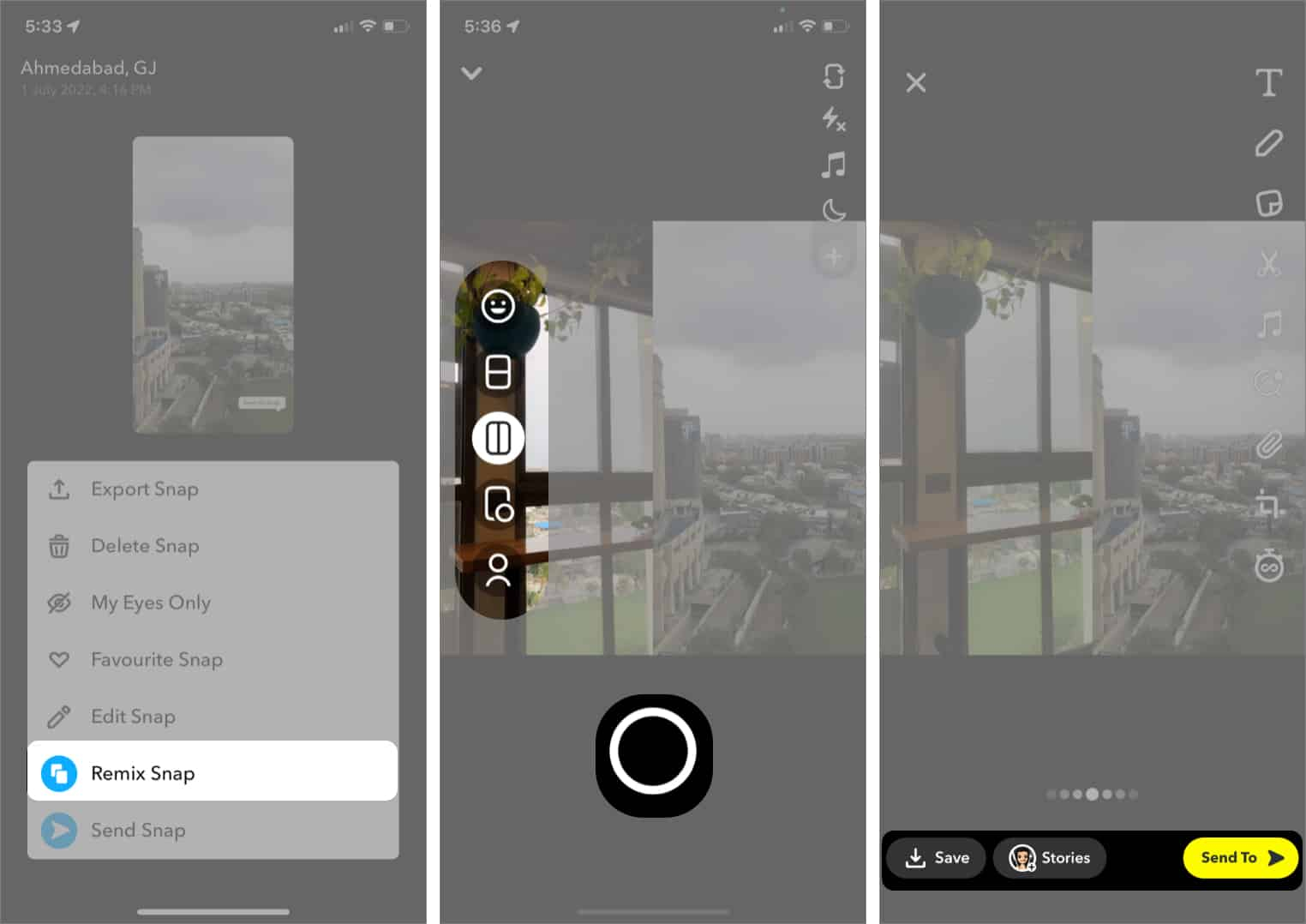

- Fewer experimental projects and more focus on core features like Stories, Chat, and AR lenses.

- Improved ad relevance as Snap upgrades its AI-driven advertising engine.

- Potential changes in how content is recommended and monetized on Discover and Spotlight.

While Snap insists the user experience will remain a top priority, platform shifts often lead to feature changes that could redefine how people use Snapchat daily.

Impact on Advertisers

For advertisers, Snap’s changes bring both risks and opportunities:

- Better ROI tracking: Snap’s planned ad upgrades could improve campaign performance.

- AR advertising growth: With Snap leading AR innovation, brands have unique ways to connect with younger audiences.

- Competition with TikTok: If Snap can’t keep up, advertisers may continue reallocating budgets.

The big question is whether Snap can convince marketers that Snapchat still delivers value in a crowded social landscape.

Snap vs. Competitors: The Bigger Picture

- TikTok: Dominates Gen Z engagement with short-form video and powerful recommendation algorithms.

- Meta (Instagram & Facebook): Despite setbacks, Meta remains the ad powerhouse with unmatched targeting capabilities.

- YouTube Shorts: Leveraging Google’s ecosystem, Shorts offers massive reach and monetization opportunities for creators.

Snap must differentiate itself through authentic social interactions and immersive AR experiences to remain competitive.

Expert Insights

- Analysts predict Snap’s restructuring is a survival move rather than an expansion strategy.

- Advertisers believe Snap must prove it can deliver better metrics before ad spending rebounds.

- Users are cautious—if Snapchat loses its fun, creative edge, they may migrate further to TikTok or Instagram.

What Snap Needs to Do Next

- Strengthen Its Ad Platform – Compete head-to-head with Meta and TikTok on targeting accuracy.

- Focus on AR Leadership – Snap has a first-mover advantage in AR filters; it must monetize them effectively.

- Reignite User Engagement – Spotlight and Discover must be retooled to bring back Gen Z loyalty.

- Diversify Revenue Streams – Subscriptions like Snapchat+ should be scaled alongside advertising.

- Global Expansion – Emerging markets hold growth potential if Snap adapts to local needs.

Conclusion

Snap’s decision to overhaul operations amid slowing ad revenue and declining user growth reflects the brutal realities of today’s social media industry. Competition is fierce, advertisers demand results, and users have endless alternatives.

For Snap, the road ahead depends on balancing innovation with profitability. If it can revamp its ad platform, leverage its AR expertise, and win back Gen Z, Snapchat may yet secure its place in the future of social media.

But if the overhaul fails, Snap risks becoming another once-popular platform overshadowed by faster, more agile competitors.